IA reports on shortage

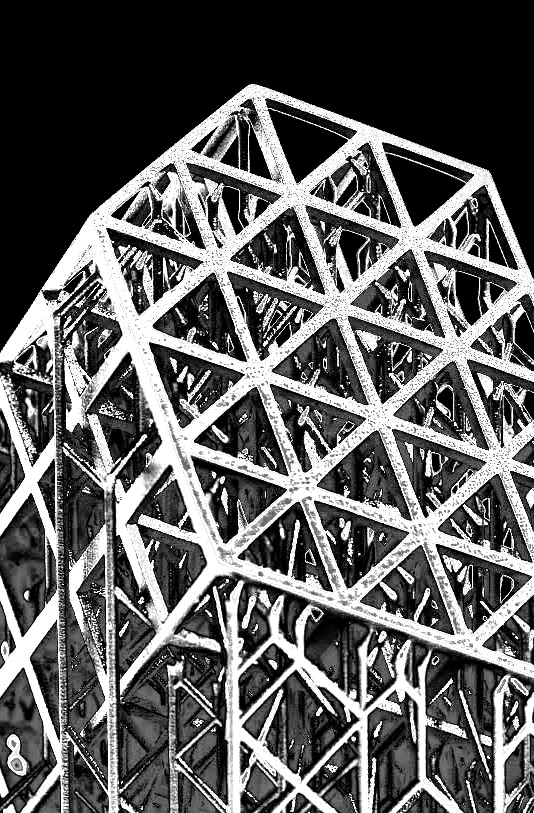

Infrastructure Australia (IA) has raised concerns about shortages in steel and building materials that could impact critical projects.

Infrastructure Australia (IA) has raised concerns about shortages in steel and building materials that could impact critical projects.

According to IA's 2023 market capacity report, steel imports into the country surged by 20 per cent in fiscal 2021 and fiscal 2022 compared to the previous two decades, prompting worries of dependence on imported steel.

IA's CEO, Adam Copp, has called on the government to investigate the steel market and ensure sufficient domestic production capabilities.

The report also highlighted shortages in domestically quarried materials like sand, cement, and plaster products, further complicating construction projects.

Additionally, Australia is grappling with a shortage of 229,000 full-time infrastructure workers, particularly engineers and scientists, while construction sector productivity remains stagnant.

Jon Davies, CEO of the Australian Constructors Association, says a comprehensive industry overhaul is needed, as well as the development of a national construction strategy to address these challenges.

Although shipping prices have decreased post-COVID-19, the IA report cautioned against excessive reliance on imported steel due to concerns about pricing, quality, and carbon emissions.

David Buchanan, CEO of the Australian Steel Association, has attributed the rise in steel imports to local companies' inability to meet construction industry demands during the pandemic. He expects imports to decrease in the upcoming quarter as local demand moderates.

Global steel prices, which spiked in late 2022 and early 2023, are now declining, and plans are in place to boost production capacity and shift to electric furnaces at the Whyalla Steelworks.

To alleviate regulatory approval delays for new quarries and ensure a steady supply of building materials, IA suggests implementing a system similar to the Victorian government's “quarry approvals co-ordination unit”.

The report revealed that it takes between five and ten years after approval to extract materials from new quarries, further exacerbating supply issues.

Cement plant closures in recent decades have left only five cement plants in Australia, operated by three companies, leading to forecasts of increased cement imports.

While overall building material costs have eased, transportation cost increases have caused prices of specific products, such as sand, cement, and plaster, to rise in fiscal 2023 compared to the previous year.

Consequently, the total cost of the five-year public infrastructure pipeline has increased by 4 per cent to $230 billion.

Print

Print